Does R&D incentive depend on market system? Is a highly competitive industry with thousands of small firms better suited for technological advantage than an industry that is made up of three or four large firms? Or is there another better suited market system?

Market Systems and Technological advance

Let’s describe short-comings and strengths of all four market systems as related to technological advance.

Pure Competition

Is there a strong incentive for a pure competitor to initiate R&D researches? A positive factor is that strong competition provides a reason for them to innovate. If a pure competitor doesn’t introduce a new-product or cost-reducing production process, then one or more of his rivals that could drive the firm away from the market. As a matter of short-run profit and long-run survival, a pure competitor is under continual pressure to improve the product and process of production, and to lower the costs through innovation. Also, in pure competitive market there a lot of firms, so there is a greater chance that this improvement in product or process may be found by more firms.

However, on the negative side, the expected return firm R&D process may be low or even negative because entry is extremely easy the profit from innovation can quickly disappear if the new firms that entered this kind of market structure are using the same new, innovated products and product technology. Also small the fact that the firms are small-sized and get only normal profit in long run leads to several questions if the R&D program is necessary in this case. Also it’s quite known that technological advance in pure competitive market system hasn’t come from R&D processes of individual firms but from example from government-sponsored researches (for example in agricultural industry fertilizers, new kinds of seed may be discovered by some governmental researches).

Monopolistic Competition

Unlike firms in pure competition market, the monopolistic competition market’s firms sell differentiated products so they have a strong incentive to engage in product development. This incentive is to make their product different from these produced by competitors, because newly produced goods may create monopoly power and thus economic profit will increase.

However in this case, like in pure competition market system there is the same negative side. Most monopolistic competitors are small sized-firms, thus their ability to secure inexpensive R&D process is limited. Moreover, monopolistic competitors find it difficult to extract large revenues from technological advantages. Economic profits are only temporary, because the entry to monopolistic competitive industry is relatively easy. In long run new entrants with similar goods reduce the revenues that came from innovation, so that the innovator gets only normal profit in future. Thus monopolistic competitors have relatively low expected rates of return.

Oligopoly

Oligopoly has many characteristics that permit technological advantage. First of all, large size of oligopolists often helps them to finance R&D process associated with product innovation. Often oligopolists realize economic profit, a part of which is saved. This retained-funding serves as a major source of available and relatively low-cost R&D. In addition, barriers to entry give assurance that firms will be able to maintain economic profits that these firm gains from innovation. Large volume of sales of oligopolists enables them to spread the cost of R&D equipment and teams of specialized researches over larger quantity of output. Finally, R&D activity in oligopolistics firms helps them to compensate inevitable R&D misses with R&D hits. That’s why oligopolists clearly have great incentive to innovate.

However R&D activities may not always have positive effect. Oligopolists may not have such a great incentive to induce innovation process. An oligopolist may say that it’s little sense to purchase costly new technology and produce new products if they are currently getting high-economic profits even without them. The oligopolists want to maximize revenues by exploiting fully capital assets. Why to produce an innovative good if the firm is producing economic profits with equipment designed to produce its existing products? There are many large firms in this kind of market system that have quite modest improvements in R&D process.

Pure Monopoly

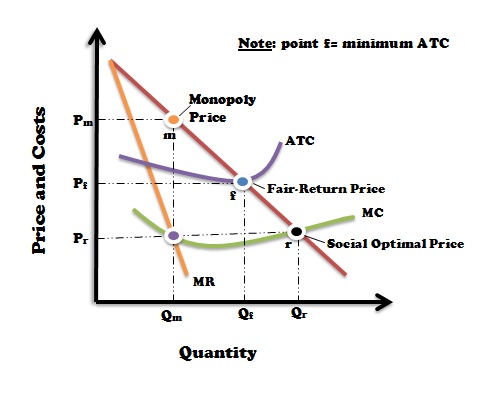

Generally pure monopolists have little incentive to engage in R&D, since it can continue to get economic profits because of entry barriers by maintaining to produce old good. The only incentive for pure monopolists to engage in R&D process is defensive: to reduce the risk of getting bankrupt by appearance of a new product or production process that may destroy it. If there is a possibility to discover a new product that will offer pure monopolists high revenues, they may have an incentive to find it. By doing this, monopolist will try to exploit new product or production process for continued economic profit or until it will get maximum possible profit from the capital that this firm assets. But generally, economists say that pure monopoly is conducting least innovation process.

Inverted-U Theory

This information can lead us to discover a new theory called inverted-U theory that makes a relationship between market system and the rate of technological advantage. This theory presents R&D spending as percentage of firm’s revenue (vertical axis) and industry rate concentration (horizontal axis). Inverted-U shape curve states that R&D efforts are weak in very low concentration ratio (pure competition) and very high concentration ration (pure monopoly).

Firms in industries with very low concentration ratio are mostly competitive ones. They are small so that financing R&D is very difficult. Entry to these industries is easy, which makes difficult to sustain economic profit from non-patented innovations. That’s why firms in these types of market systems spend little from their revenues on R&D. In Contrast, in the part of the curve where concentration ratio in very high economic profits are very-high so innovation will not add more profit. Moreover, innovation requires costly “retooling” of big firms, which will create a great amount of lost money for whatever addition profit is. That’s why in the right part of the graph the expected rate of return from R&D is very low, and the expenditures on this process are low too. Also, lack of rivals make monopolist to spend less money from their revenues on this process.

The optimal industry for R&D is the one in which returns from innovation spending are high and the funds to finance this process is available and inexpensive. These factors seem to describe industries in which where there a few very large firms and where concentration ratio is not so high to prohibit competition by smaller rivals. Rivalry among larger oligopolistic firms and competition between larger and smaller firms provide a strong incentive for R&D. The inverted U theory shows that loose oligopoly is the optimal structure for R&D spending.

Market Structure and Technological Advantage: Conclusion

Other things equal, the optimal market structure for technological advantage seems to be an industry in which there is a mix of large oligopolistic firms (40 to 60 percent concentration ratio) with other smaller innovative firms.

“Other things equal assumption” is quite important here. If a specific industry is highly technical may be more important determinant for R&D than its structure. While some concentrated industries (like electronics, machineries) spend large quantities of money on R&D and are very innovative, others (like copper, cigarettes) are not. Level of R&D depends on its technical character and technological opportunities in its market structure. Simply, it’s easier to innovate a computer industry than a copper one.

Conclusion: The inverted-U curve is useful depiction of general relationship between R&D spending and market structure, other things equal.

Tags: 2012, blog, blogging, business, economics, Inverted-U Theory, justdan93, Market structure and R&D Incentive, Market Structure and Technological Advantage, Market Systems and Technological advance, marketing, microeconomics, monopolistic competition and technological advance, oligopoly and technological advance, profit from innovation, Pure Competition and technological advance, pure monopoly and technological advance, science, Technological advance, technological advantage, writing